After reading a post on Bucking the Trend’s (now defunct) site entitled, How Vanguard Will Save Me $2,700 and the outstanding must-read Stock Series by JL Collins, I realized I needed to learn more about low-cost index fund investing.

I picked up The Little Book of Common Sense Investing by Vanguard founder John Bogle and it turned my financial world upside down in the most positive way possible. It was so elegant and compelling in its simplicity that I was instantly hooked. I consider this book an absolute must-read, so I hope you pick it up (at the library of course).

The Basics

I’d sum up his entire theory this way: There is essentially not one person on earth who can beat the stock market over a long-term period, and therefore the best anyone can hope for is to match the returns of the stock market. Any fees you pay to a mutual fund, financial advisor, commission, trading fees, etc. just pull down your return as compared with the overall market.

When you hear that a mutual fund has a 0.75% expense ratio and maybe your financial advisor charges you 1.25% of your ‘assets under management,’ it just doesn’t sound like a lot. As we’ve pointed out before in our The Miracle of Compound Interest article, it is astounding how small differences in returns can make a significant impact on your account balances when compounded over a long period of time.

An Example

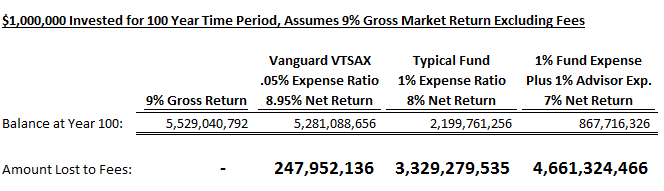

To illustrate, I made a wild example in the below chart showing what a $1,000,000 investment would be worth after 100 years compounded at a 9% gross annual rate. I then reduced that 9% return in three ways: 1) by the 0.05% expense ratio on Vanguard’s VTSAX Fund (Total Stock Market Index Fund) for an 8.95% net annual return 2) by the typical 1% mutual fund expense ratio for an 8% net annual return 3) by the 1% mutual fund fee plus 1% for a financial advisor’s fee for a 7% net annual return:

As you can see above, these fees make an unbelievable difference when compounded over this time period! The $1.0 million investment would be worth $5.53 billion at the 9% gross return (!), but only $867 million at 7%. You would literally lose $4.66 billion just by using an investment advisor who had you invested in a 1% expense ratio mutual fund. You’d lose $3.33 billion if you were smart enough to invest on your own, but for whatever reason invested in a mutual fund with a 1% expense ratio.

Or, you could buy the VTSAX index fund and own your piece of the entire US Stock Market and only pay 0.05% for the right to do so. You’d still lose $248 million to fees, but since this is essentially the lowest expense ratio available to common investors, you can’t do any better than that.

A Slightly More Realistic Example

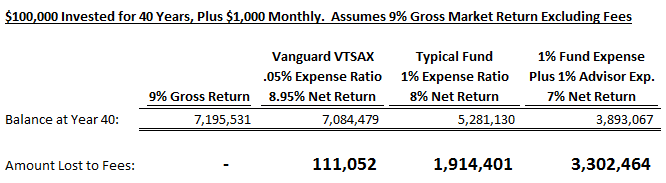

Let’s look at someone who has $100,000 saved up and continues to invest $1,000 per month for 40 years:

(NOTE: This article was created in 2013 when 1) the expense ratio on VTSAX was 0.05%. It is actually lower now! 2) I assumed a 9% gross market return. Today I assume 8%, but the math still holds below to illustrate this point.)

With the advisor and 1% fund fee, they’d lose roughly half of their potential investment balance; with just the 1% fee they’d lose more than 25% of their potential balance, but with the Vanguard index fund they’d only lose 1.5% total over the 40-year period.

If you believe, like John Bogle and Warren Buffett do, that owning low-cost mutual funds is the best possible option for everyday investors, then it’s hard to go wrong with a fund like VTSAX.

2024 update: I prefer the Vanguard ETF version ‘VTI’ today because you can buy it without commissions or fees at places like Fidelity, Schwab and of course you wouldn’t pay fees for either VTSAX or VTI at Vanguard itself.

But realistically, there are many options for ‘Total Stock Market’ and ‘S&P 500’ mutual funds and ETFs outside of Vanguard that are fantastic.

I recommend the ETF versions because often people make the mistake of buying another firm’s mutual funds at a brokerage (for instance, they have a Fidelity brokerage account and try to buy VTSAX there) and get hit with hefty fees (think $75 each time!) that make no sense.

There’s nothing inherently special about VTSAX, it is only a single example of a ‘total stock market’ mutual fund, but it is not worth paying fees just to have VTSAX because you heard someone mention it in the FI world somewhere!

Richmond Savers has partnered with CardRatings for our coverage of credit card products. Richmond Savers and CardRatings may receive a commission from card issuers.