We read a recent newspaper article that discussed simple rules for a financial lifetime that would fit on just one index card, and while many of them were incredibly similar to concepts we describe here on RichmondSavers.com, some of them were too specific even for the average person.

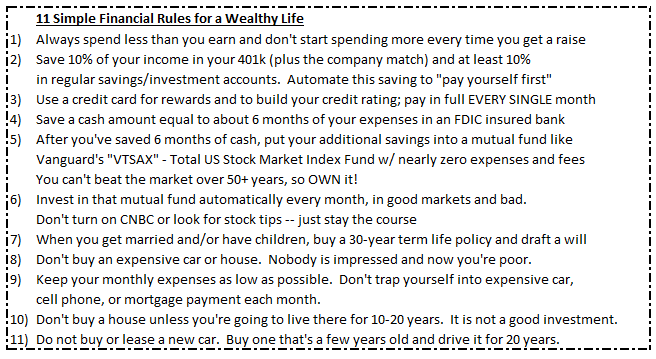

With that in mind, we came up with our 11 Simple Financial Rules for a Wealthy Life, which when drafting we envisioned fitting in the wallet of every recent college graduate in America as simple advice to follow to nearly ensure yourself a prosperous financial life.

Simplicity Is Often the Best Financial Advice

We all often get bogged down in the details of life, but if you adhere to a measure of simplicity and try to avoid complexity and stress when they aren’t necessary, you can enjoy your journey much more and end up way ahead financially.

Richmond Savers has partnered with CardRatings for our coverage of credit card products. Richmond Savers and CardRatings may receive a commission from card issuers.