I know the title of this article is a bit provocative, and rest assured that I do not in any way mean for this to be a political argument; I just know the subject of taxation can be a boring one, and as a CPA I like to make taxes much more interesting if possible.

I know the title of this article is a bit provocative, and rest assured that I do not in any way mean for this to be a political argument; I just know the subject of taxation can be a boring one, and as a CPA I like to make taxes much more interesting if possible.

For example, you should check out some of our favorite tax saving strategies, which involve stacking your tax-free dollars for HUGE savings (potentially thousands of dollars in a single year).

But back to the matter at hand, I’m going to focus on the concept of marginal tax brackets and the federal income tax calculation in general. There’s an incredible amount of confusion when it comes to “tax brackets”; many people, even financially literate and educated ones, think that your ‘tax bracket’ means that every dollar of your taxable income gets multiplied by that tax rate and that’s the amount of federal income tax you owe.

That is not the case at all.

Marginal Tax Brackets

What people think of as your tax bracket is really what’s known as your ‘marginal tax bracket.’ This means that your next (marginal) dollar is taxed at this rate, not every dollar that came before it. The tax brackets for 2016 are as follows for taxable income (the amount after all your deductions) for a couple that files married filing jointly:

| If taxable income is: | The tax is: |

|---|---|

| $0 to $18,550 | 10% |

| $18,550 to $75,300 | $1,855.00 plus 15% of the amount over $18,550 |

| $75,300 to $151,900 | $10,367.50 plus 25% of the amount over $75,300 |

| $151,900 to $231,450 | $29,517.50 plus 28% of the amount over $151,900 |

| $231,450 to $413,350 | $51,791.50 plus 33% of the amount over $231,450 |

| $413,350 to $466,950 | $111,818.50 plus 35% of the amount over $413,350 |

| $466,950+ | $130,578.50 plus 39.6% of the amount over $466,950 |

(See this article at taxfoundation.org to see the tax tables for all taxpayers.)

As you can see, the first $18,550 of everyone’s taxable income is taxed at a 10% rate. Then the next $56,750 is taxed at a 15% rate.

For the vast majority of taxpayers, this is the highest rate they’ll pay on their next dollar of income because most people don’t have taxable income above $75,300.

Example: Family of four with a $100,000 income

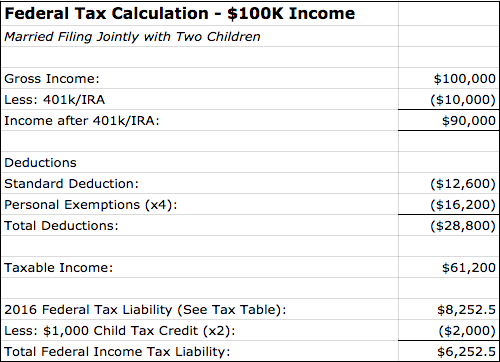

To illustrate the tax calculation for a family of four with a $100,000 income, I’m going to calculate their tax liability just using the regular standard deduction and personal exemptions, so this is as conservative as possible. This assumes they do not itemize their deductions and have nothing else of note other than that they are saving 10% of their income in a 401k like we recommend.

I understand $100k is a significant amount of income in general (we are assuming two working spouses each making $50,000 per year), but I think that makes the results that much starker when you see how little most people are paying in federal income taxes (and how overblown most people’s protestations are about their “crushing” tax burden):

As you can see, we take their $100,000 income and subtract the deductible $10,000 that was contributed to their 401k account(s). We then take the remaining $90,000 and subtract the $12,600 standard deduction as well as the personal exemption of $4,050 for each family member ($4,050 x 4 = $16,200). The result is a taxable income of $61,200.

We look to the table above and the first $18,550 of this $61,200 is taxed at 10% ($1,855 tax liability) and the remaining $42,650 is taxed at 15% ($6,397.5 tax liability) for a total income tax liability of $8,252.5.

At this taxable income level this family would qualify for the Child Tax Credit on each of their two children, which reduces the tax liability by $2,000 for a total federal income tax liability of $6,252.5 on $100,000 of gross income. This equates to a 6.25% effective tax rate on the gross income.

All taxes paid:

- Federal Income tax: $6,252.5

- Federal Payroll tax: ($100,000 x 7.65%) $7,650

- Estimated State Tax @ 6%: ($61,200 x 6%) $3,672

- Estimated Property Taxes: $2,000 (middle-class home in Richmond, VA)

- Estimated Other Taxes (Sales, personal property, etc.): $1,000

- Total Tax Burden on $100,000 income = $20,574.5 for an effective rate of 20.57%

Richmond Savers has partnered with CardRatings for our coverage of credit card products. Richmond Savers and CardRatings may receive a commission from card issuers.