We recently discussed how medical bills provide an opportunity to earn credit card rewards, which in turn can lower your total medical expenses. It’s a really neat concept that can make an expensive situation much more pleasant and affordable. But if you have a Health Savings Account (HSA), you can actually stack even more savings to really sweeten the deal. Let’s take a closer look.

We recently discussed how medical bills provide an opportunity to earn credit card rewards, which in turn can lower your total medical expenses. It’s a really neat concept that can make an expensive situation much more pleasant and affordable. But if you have a Health Savings Account (HSA), you can actually stack even more savings to really sweeten the deal. Let’s take a closer look.

HSA Basics

You might be familiar with the concept of an HSA. It’s a tax free savings account designed to make saving and paying for medical expenses a little easier. The rules are pretty straightforward–for 2016:

- individuals can contribute up to $3,350

- families can contribute up to $6,750

- distributions for medical funds are tax-free

- growth (interest and dividends) are tax-free

- funds can be used on a wide variety of medical expenses, including traditional doctor visits, surgeries, hospital care, non-cosmetic dental care, vision, prescriptions, over the counter medication, and more

An HSA accompanies a High Deductible Health Plan (HDHP). And while HDHPs aren’t always popular with people who haven’t used them before (because they seem more expensive), they can often save you a good bit of money if you’re young and/or have limited medical expenses. They’re pretty popular in the personal finance community, and great if you prefer to self-insure rather than being forced to pay up for a large premium even if you don’t need significant care. Additionally, many employers will contribute some amount to the HSA if you opt into a HDHP, which also essentially lowers your deductible by the amount contributed.

And lastly, you can hold onto an HSA after you quit HDHP coverage. You won’t be able to add more money, but you’ll still have the chance to spend what you’ve put aside tax free.

Using an HSA to Reimburse Yourself

Those are the “basics,” but what many people don’t know is that you can use your HSA to reimburse yourself after using a different payment method. Typically, your HSA issuer will provide you with a debit card, but you aren’t required to use it. What this means is that you can pay for your medical expenses with a credit card to earn rewards and then reimburse yourself from the HSA. You’ll just need to keep your receipts or other documentation to show that you paid for a qualifying expense.

An example

Note: the example below uses tax numbers from 2016, but the concept still applies! Let’s repeat the example from our previous post about paying for medical expenses with a credit card. There we used a hypothetical $6,000 medical expense, which earned $1,178 in credit card rewards via two hypothetical credit cards with a minimum spend requirement of $6,000. If we throw an HSA into the mix, things get even more interesting.

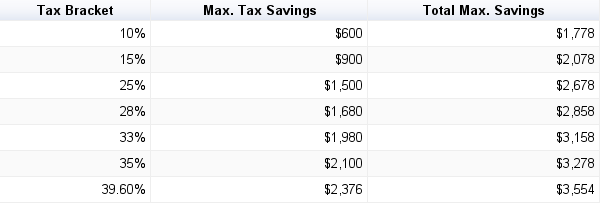

If you’re in the 25 percent income tax bracket, using an HSA for the full $6,000 will save you $1,500 in Federal income tax (plus state tax savings that we’re not including). Combine that with the $1,178 earned in credit card rewards, and you reach a total savings of $2,678, or 44.6 percent! That is unbelievable and an amazing increase in savings over using the credit card points alone. Here’s how this would look at various tax brackets:

The only drawbacks to this method are that you’ll need to keep documentation, and there may be a little work involved in processing the reimbursement with your HSA provider. Really though, those are just minor obstacles considering the potential savings.

Oh, and if you’re wondering whether this trick would also apply to a flexible spending account (FSA), the answer is YES. That can open the doors to even more “double dip” savings opportunites.

Have you ever stacked rewards and HSA tax advantages? Let us know in the comments below!

Richmond Savers has partnered with CardRatings for our coverage of credit card products. Richmond Savers and CardRatings may receive a commission from card issuers.